Real Estate (REIT) Modeling – Wall Street Prep

Description

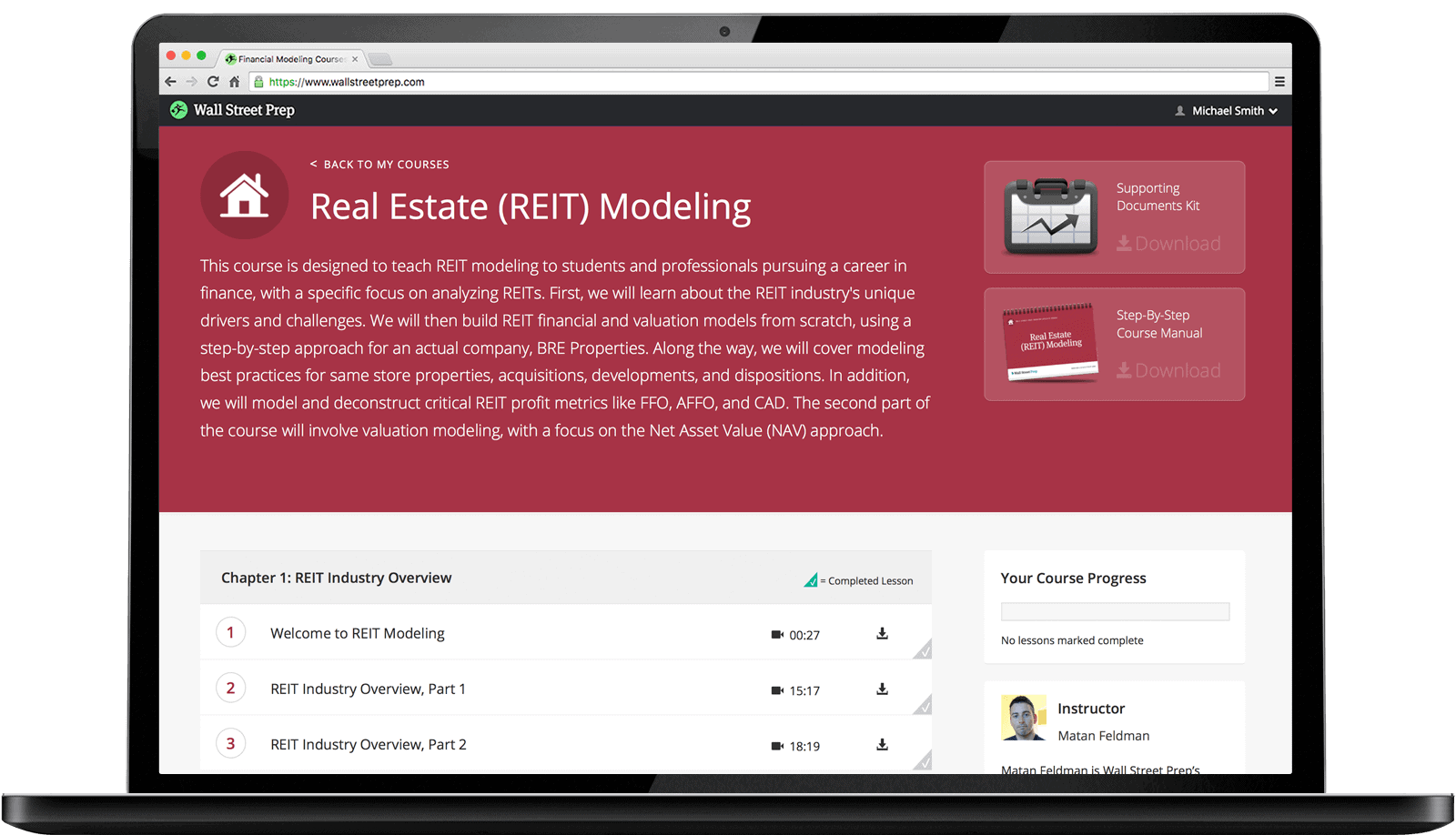

Real Estate (REIT) Modeling – Wall Street Prep

Download Now Wall Street Prep – Real Estate (REIT) Modeling. Download This Course For Cheap Price…

Description of Real Estate (REIT) Modeling

This REIT modeling course is ideal for investment banking, equity research, and real estate professionals with a focus on REITs. Trainees build financial and valuation models for a REIT the way it’s done on the job.

First, we will learn about the REIT industry’s unique drivers and challenges. We will then build REIT financial and valuation models from scratch, using a step-by-step approach for an actual company, BRE Properties. Along the way, we will cover real estate modeling best practices for same store properties, acquisitions, developments, and dispositions. In addition, we model and deconstruct critical REIT profit metrics like FFO, AFFO, and CAD. Part 2 dives into valuation modeling, with a focus on the Net Asset Value (NAV) approach.

What You’ll Learn In Real Estate (REIT) Modeling

In-depth REIT industry profile, drivers, terminology, tax advantages and structure (UPREIT’s and DOWNREIT’s)

Segment-level modeling (same store properties, acquisitions, developments, and dispositions)

REIT sector-specific drivers and forecasting best practices

Common REIT valuation approaches including Net Asset Value (NAV), comparable company and transaction analyses, and discounted cash flow (DCF) analysis

Modeling REIT-specific metrics and ratios – funds from operations (FFO) and adjusted funds from operations (AFFO / CAD)

Content:

Chapter 1: REIT Industry Overview

1. Welcome to REIT Modeling

2. REIT Industry Overview, Part 1

3. Course Downloads

4. REIT Industry Overview, Part 2

Chapter 2: Modeling A REIT’s Income Statement

5. Modeling the Income Statement, Part 1

6. Modeling the Income Statement, Part 2

7. Modeling the Income Statement, Part 3

Chapter 3: Understanding & Modeling REIT’s Segments

8. REIT Segments: Same Store Sales, Part 1

9. REIT Segments: Same Store Sales, Part 2

10. REIT Segments: Same Store Expenses and NOI

11. REIT Segments: Lease Ups, Renovations & Acquisitions

12. REIT Segments: Dispositions & Discontinued Ops, Part 1

13. REIT Segments: Dispositions & Discontinued Ops, Part 2

14. Modeling Segments: Same Store Properties

15. Modeling Segments: Acquisitions

16. Modeling Segments: Dispositions

17. Modeling Segments: Discontinued Ops and Dispositions Cleanup

18. Modeling Segments: Development

Chapter 4: Ancillary Income & Non-Operating Items

19. Modeling Ancillary and Other Income

20. Modeling Non-Operating Income and Finishing the Income Statement

Chapter 5: Understanding the REIT Balance Sheet

21. Understanding the Balance Sheet: Assets and A/P

22. Understanding the Balance Sheet: Non-Debt Liabilities

23. Understanding the Balance Sheet: Debt

Chapter 6:Modeling the REIT Balance Sheet

24. Modeling Real Estate Assets

25. Modeling CIP and Accum. Depreciation

26. Modeling Other Assets

27. Modeling Non-Debt Liabilities and Equity

28. Modeling Non-Revolver Debt

29. Balance Sheet Cleanup

Chapter 7: Cash Flow Statement & Model Cleanup

30. Understanding the Cash Flow Statement

31. Modeling the Cash Flow Statement

32. Pre-Revolver Model Cleanup

Chapter 8: The Revolver, Interest Expense & Circularity

33. Understanding the Revolver

34. Modeling the Revolver

35. Understanding Interest Expense

36. Modeling Interest Expense

37. Understanding Circularity

38. Handling Circularity in a Model

Chapter 9: Modeling Future Developments

39. Understanding a REIT’s Developments

40. Modeling Developments, Part 1

41. Modeling Developments, Part 2

42. Modeling Developments, Part 3 & Finishing the Model

Chapter 10: Funds from Operations (FFO) & CAD

43. Understanding EBITDA, FFO and CAD

44. Modeling EBITDA, FFO and CAD

Chapter 11: REIT Valuation & the NAV Model

45. Introduction to REIT Valuation & NAV

46. NAV Modeling, Part 1

47. NAV Modeling, Part 2

48. The End

49. REIT Modeling Review

Prerequisites

This course does not assume a prior background in Real Estate (REIT) Modeling. However, those who enroll should have an introductory knowledge of accounting (e.g. interaction of balance sheet, cash flow, and income statement) and proficiency in Excel. Students with no prior background in Accounting should enroll in the Accounting Crash Course. Students with limited experience using Excel should enroll in the Excel Crash Course.