WHAT YOU GET?

This Toolkit includes frameworks, tools, templates, tutorials, real-life examples, best practices, and video training to help you:

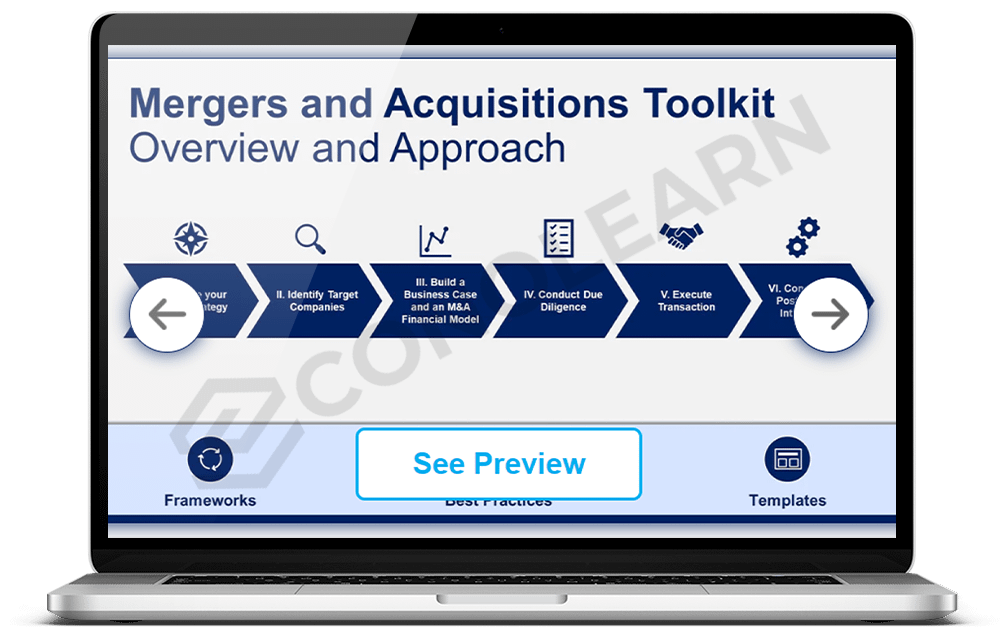

Increase your M&A success rate with our 6-phase M&A approach: (I) Define your M&A strategy, (II) Identify target companies, (III) Build a business case and financial modeling, (IV) Conduct due diligence, (V) Execute transaction, (VI) Conduct post-merger integration

Define your M&A strategy: (1) Company mission, vision and values, (2) M&A strategic objectives and key performance indicators, (3) M&A team, (4) M&A guiding principles, (5) Target screening criteria

Identify target companies: (1) Potential target companies and data collection, (2) High-level assessment of potential target companies, (3) Shortlisted potential targets, (4) Financial statements analysis, (5) Business valuation: DCF model, comparable company analysis, and precedent transaction analysis, (6) Targets approved for the business case phase

Build a business case and an M&A financial model: (1) Strategic benefit, (2) Feasibility, (3) Financial benefit, (4) Comprehensive M&A financial model including acquirer model, target model, merger assumptions & analysis, and pro forma model, (5) Simple Financial model including integration cost, revenue synergy, cost synergy, NPV, ROI, and IRR, (6)Letter of intent or term sheet

Conduct due diligence(CDD) to identify the likely future performance of a company: (1) Work plan including key business case hypotheses and assumptions, (2) Due diligence to validate key hypotheses and assumptions, (3) Updated business valuation, (4) Recommendation to make (or not) a formal offer to acquire the target company

Execute transaction: (1) Deal structure, (2) M&A negotiations, (3) Signing and closing the M&A deal

Conduct successful post-merger integration to ensure the company reaches its cost and revenue synergy targets: (1) Post-merger integration strategy and high-level plan, (2) Post-merger integration detailed plans, (3) Implementation and monitoring