Amy Meissner – The HV7 Option Trading System

Original price was: $247.00.$49.50Current price is: $49.50.

Description

The HV7 Option Trading System

A No-Touch Options Trade for High Volatility Markets.

What is the HV7 Option Trading System?

The HV7 Option Trading System is a market signal paired with a very short term, high probability market neutral options strategy for high volatility markets. It is suitable for small or large account and has simple entry and no adjustments.

About Amy Meissner

Amy Meissner

Amy began exploring options trading while still working in the software and multimedia industries in the mid-1990’s, trading credit spreads in the SPX. It was hit or miss back then, but wanting to learn more and get serious about making a living trading options, Amy felt encouraged to come back and give the options initiative another look in 2005. After garnering a steady earnings stream and making continuous efforts to improve the quality of her trading strategies, she made options trading her full time occupation in 2006. Along the way she found some good mentors who gave her the confidence to refine proven methodologies and make them uniquely her own.

Amy’s specialty is options trading for monthly income using high probability option strategies. She is an active member in the options trading world, and is a sought-after webinar leader. Within the professional options trading community, Amy is known as a stable, disciplined trader who calmly manages her risk throughout the life of the trade even in volatile market conditions. She will tweak her approach slightly from time to time, making small adjustments here and there as the market moves and changes, but consistency is her distinguishing virtue. Amy’s steady confidence and sound methodology have rewarded her with steady returns, year after year.

What is the HV7 Option Trading System?

The HV7 Option Trading System is Amy’s latest iteration in her trading journey that targets specific high volatility events as a signal to enter a trade. This is paired with a very short term weekly strategy that is specifically set up to take advantage of when volatility hits this markets.

Amy wanted to address challenges with the trading in a high volatility environment. She also wanted a short term strategy that was suitable for small or large account with high returns.

Amy is well known for teaching several trading systems including:

The Asymmetric Iron Condor (aka “the Weirdor”)

The Nested Iron Condor

The Timezone Trade

The 14-Day Asymmetric Iron Condor

The A14 Weekly Options Strategy

Amy wanted to address challenges with the trading in a high volatility environment. She also wanted a short term strategy that was suitable for small or large account with high returns.

HV7 Option Trading System Benefits

Specific signal tells you when it’s the best time to enter a trade

Simple setup with a single order at entry. No need to multiple legs.

Basic entry

Low margin entry option

93% win rate over the last 10-years with 100% wins in 2022 through May 31st.

No adjustments needed

Uses GTC orders to exit to no need to watch the market all day

Quick exit with an average of two days in each trade

Uses SPX index options with are highly liquid with favorable U.S. tax benefits

Can be used with RUT index options (all examples and performance testing done with SPX)

HV7 Option Trading System Overview

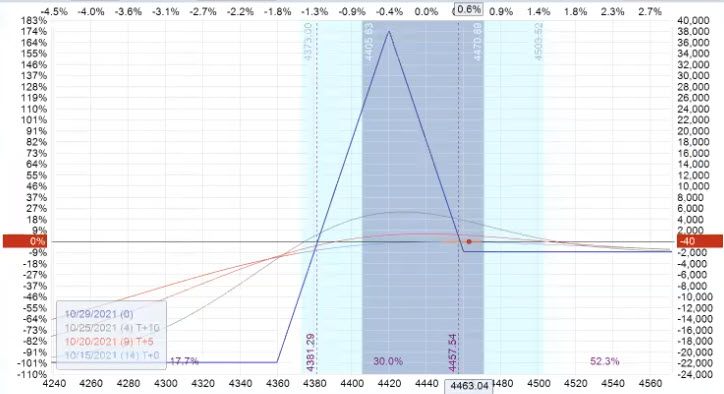

Standard Entry Planned Capital is $5,000 with $2,800 average margin.

Low Margin Entry Planned Capital is $1,500 with $1,200 average margin.

Profit target is 5% of margin.

Losses average ~8.7%

Win/Loss Expectancy was 14.1667.

Profit Factor is 9.8735

10-Year HV7 Option Trading System Performance Statistics

SPX Standard Entry

What You’ll Get

HV7 Entry Signal: What is the criteria and how to set alerts so you know exactly when to enter a trade

How to set up the HV7 trade position step by step. Includes additional set-up for lower margin version and covers the differences and benefits of each

Exactly when and how to exit the trade including the use of GTC orders

Examples of multiple trades throughout the extensive 10 year backtest

Bonus example trades using the lower margin version plus some example trades using the RUT index

Complete ONE trade log of the 10 year backtest of trades (April 2012-May 2022)

Private forum for students to interact with each other

Classes will be recorded live and includes time for Q&A to answer your questions

BONUS: An additional live Q&A session will be scheduled 30-60 days after the original live classes

All classes and bonus sessions will be recorded and available for playback

Get Instant Download this course at Shoppycourses

Sale Page: https://info.aeromir.com/hv7/